irs child tax credit 2022

This will be the amount that eligible taxpayers with children under 17 at the end of 2022 will be able to claim when they file their tax returns next year minus any last-minute surprise. That means that when parents claim the tax credit on their returns next year the benefit will be reduced to the previous maximum of 2100.

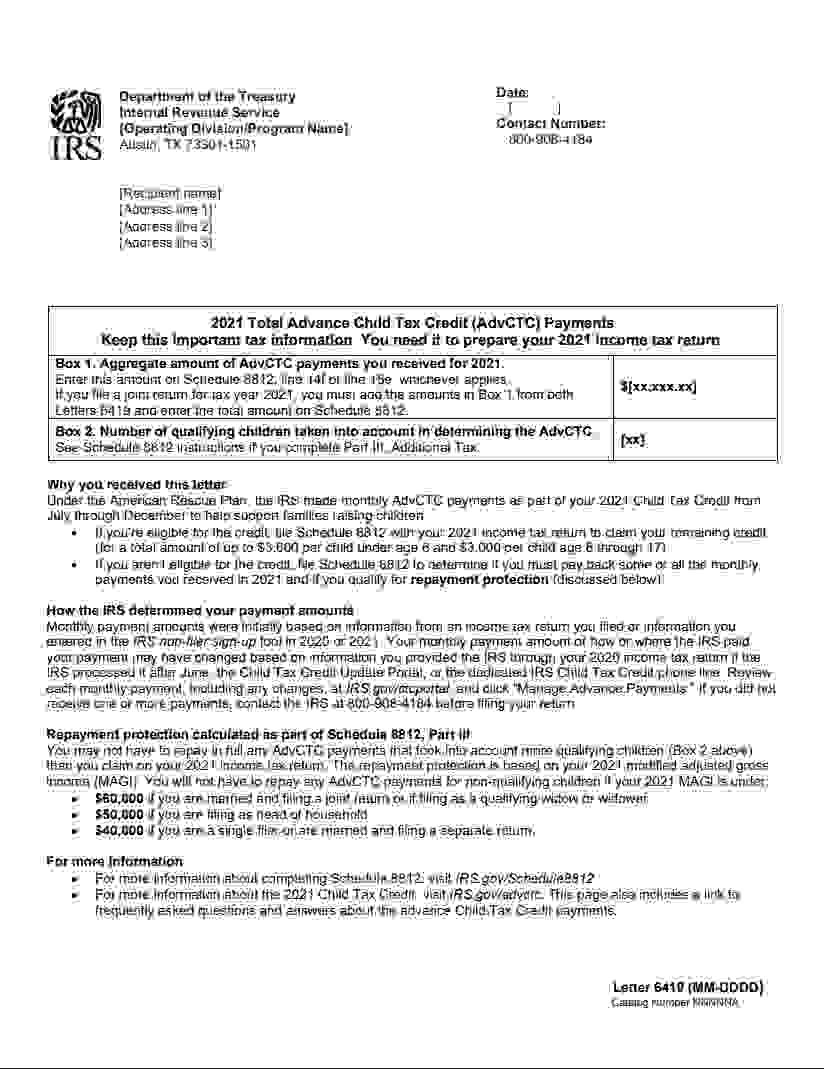

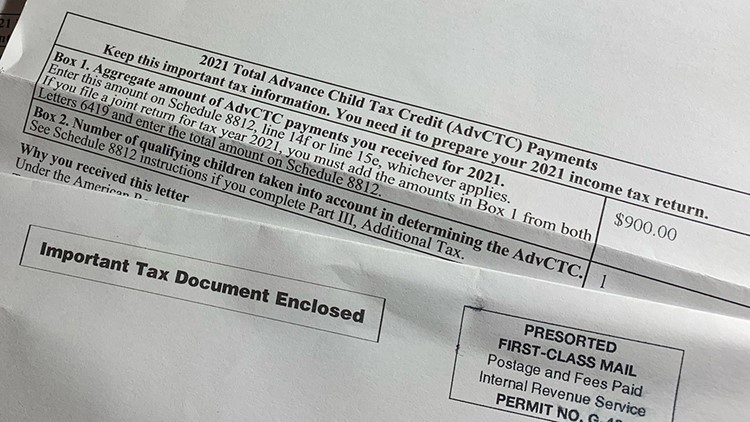

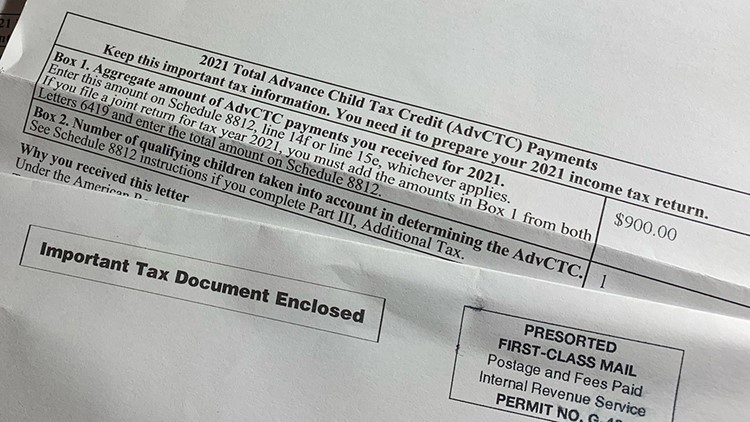

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

This impacted tens of millions of families who received up to 300 per child each month from July to December.

. You could receive your money as early as February 19 but in a lot of cases it will not be until March 1. Income thresholds of 400000 for married couples and 200000 for all other filers single taxpayers and heads of households. Report the advance Child Tax Credit payments you and.

Page Last Reviewed or Updated. While the monthly advance payments ended in december the 2022 tax season will deliver the rest of the child tax. For children aged 6 to 17 the amount increases from 2000 to 3000.

Child Tax Credit 2022. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. IR-2022-53 March 8 2022.

Tax refunds could bring another 1800 per kid. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. A 2000 credit per dependent under age 17.

As per irs child tax credit portal parents and caretakers get half amount in advance in 2021 and half when they file taxes. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. The amount of the Child Tax Credit that you and your spouse can properly claim on your 2021 tax return.

When is the IRS releasing refunds with CTC. President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17.

As a result of the American Rescue Act the child tax credit was expanded to 3600 from 2000. This also means that families will once again have to wait for their tax refund to see the money. The 2000 credit increases to 3000 for children between 6 and 17 The 2000 credit increases to 3600 for children under 6 at the end of 2021.

A group of parents who received their July payment via. Figure your 2021 Child Tax Credit. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates. The total amount of the advance Child Tax Credit payments that you and your spouse received during 2021. Washington lawmakers may still revisit expanding the child tax credit.

But TIGTAs testing of rules for the child tax credit including advance payments showed they are working as intended As of March 2 2022 the IRS had processed more than 149 million returns claiming 827 billion in child tax credits of which 337 million had been paid in advance during 2021. Not only that it would have modified it to include the following. Child Tax Credit 2021 vs 2022 The 2021 credit increased to 3600 from 2000 in 2021 and you receive a credit for each child under six years of age.

A 70 percent. For 2022 the tax credit returns to its previous form. Joe Manchin D-WVa has been clear he.

The IRS announced a technical issue that could affect up to 15 percent of recipients of the Child Tax Credit. Use Schedule 8812 Form 1040 to. MILLIONS of families can expect to get the rest of their child tax credit payments from last year in 2022 but theyll need to wait.

Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. Enter Payment Info Here tool or. You can receive a refund until March 1 2022 if you have filed online have chosen to receive a refund by direct deposit and there are no problems.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. For the 2022 tax filing season eligible individuals are able to claim 3600 for each child under the age of 6 and 3000 for kids between the ages of 6 and 17. T I have Earned Income Tax Credit EITC or Additional Tax Credit for Children ACTC v United States has become a welcome boost for many people but there are still those who need to return the money.

However for 2022 the credit has reverted back to 2000 per child with no monthly payments. For 2021 only tax returns filed in April 2022 the Child Tax Credit for children under 17 changes in the following ways. The most recent version of the Build Back Better plan would extend the expanded child tax credits 3000 and 3600 for the 2022 tax year.

The Child Tax Credit Update Portal is no longer available.

Child Tax Credit Advance Monthly Payments Explained Donovan

For 2021 Only The Irs Is Letting More People Without Children Qualify For A Tax Credit In 2022 Tax Credits Irs Filing Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kokh

Child Tax Credit Letters From Irs Showing Up In Mailboxes Wusa9 Com

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Irs Warns Of Child Tax Credit Scams Abc News

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Child Tax Credit Dates As Irs Set To Send Out New Payments

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

The Irs Is Shutting Down Its Child Tax Credit Portal For Now Best Life In 2022

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Inflation Ruining Your Budget 3 Clever Ways To Save While Shopping And More In 2022 Child Tax Credit Irs Taxes Tax Refund

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments