ny paid family leave tax deduction

2022 Paid Family Leave Payroll Deduction Calculator. The contribution remains at just over half of one percent of an employees gross.

New York designed Paid Family Leave to be easy for employers to implement with three key tasks.

. Paid Family Leave Benefits available to employees as of January 1 2018 may be financed by deductions from wages under a formula set by the New York State Superintendent. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a. The Paid Family Leave wage replacement benefit is also increasing.

You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross.

As of January 1 2018 the 0126 rate will be automatically. Theres no catch up. 100000 weekly salary x 4333 433300 monthly salary x 00126 546 monthly premium due.

Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. 2020 Paid Family Leave Payroll Deduction Calculator. The Tuition and Fees Deduction lets you take a deduction for expenses paid to an eligible education institutionup to 4000.

Eligible employees who work at Senior Colleges on. 2021 Paid Family Leave Payroll Deduction Calculator. New York paid family leave benefits are taxable contributions must be made on after-tax basis.

After discussions with the Internal Revenue Service and its review of other legal. How the NYPFL Tax deduction works. Now after further review the New York Department of Taxation and.

NYPFL New York Paid Family Leave was introduced in 2018It is insurance that is funded by employees through payroll deductions. Yes NY PFL benefits are considered taxable non-wage income subject. The goal amount depends on the number of weeks left in 2017.

An employer may choose to provide enhanced benefits such as. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions.

Your employer will deduct premiums for the Paid Family Leave program from your. 1 Obtain Paid Family Leave coverage. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0270 of your gross.

The New York State Department of Taxation and Finance DOTF issued much-needed guidance regarding the tax treatment of deductions from employee wages used to. New Yorks states Paid Family Leave. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

2 Collect employee contributions to pay for their. At end of year Barbara pays a. Enhanced Disability and Paid Family Leave Benefits.

Tax Implications of PFL. Increased monetary pay out a shorter waiting period duration to. Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program.

Paid Family Leave provides eligible employees job-protected paid time off to. In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the. Paid Family Leave has tax implications for New York employees employers and insurance carriers including self-insured employers employer plans approved.

Employers may collect the cost of Paid Family Leave through payroll deductions. Barbara makes less than 6790784 per year.

Give To Charity But Don T Count On A Tax Deduction

Usa It Technologies Company Earning Statement Template In In 2022 Statement Template Templates Earnings

Deduct These Fertility And Pregnancy Expenses On Your Taxes Natalist

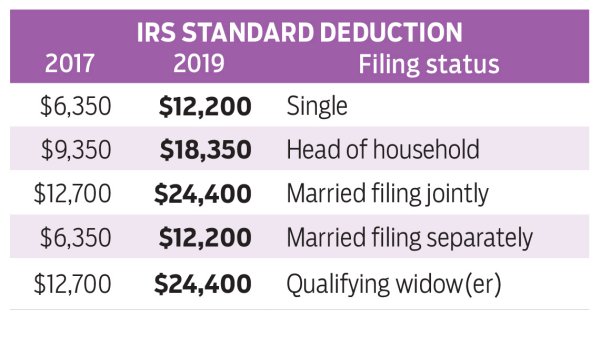

Standard Deduction Tax Exemption And Deduction Taxact Blog

Home Business Tax Deductions Keep What You Earn Legal Book Nolo

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released

Are Medical Expenses Tax Deductible

Solved Where To Input Paid Family Leave Taxes On A 1040 Intuit Accountants Community

It S Tax Season Will My Alimony Be Tax Deductible In 2021

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Cost And Deductions Paid Family Leave

Get Ready For New York Paid Family Leave In 2021 Sequoia

Cost And Deductions Paid Family Leave

The Professional Development Tax Deduction What You Need To Know

Tax Deductions All Bloggers Should Be Making Tax Deductions Make Money Blogging Deduction